An online essay favoring independence for Puerto Rico said, “Territories do not have to pay federal income taxes. This is one of the top advantages of not being a state. This ultimately drives economic activity to Puerto Rico…With a poverty rate as high as it is in Puerto Rico, the nation needs as many resources as it can possibly get.”

Do tax incentives drive economic activity to Puerto Rico?

The problem with the idea that low income taxes bring investment to Puerto Rico is that it doesn’t actually work that way.

Major corporations certainly do make efforts to avoid taxes, Corporate tax incentives allow companies in Puerto Rico to pay very little in federal and local taxes for profits earned in Puerto Rico.

That means that companies want to show that profits in Puerto Rico are high. That doesn’t make them move their production to Puerto Rico, however. They want to keep their expenses in high-tax jurisdictions. So a company might build a factory in North Carolina, hire workers in North Carolina, buy materials in North Carolina…and put a patent in the name of a Puerto Rico subsidiary. The company gets their tax deductions by investing in North Carolina. Then they pay an enormous fee to the Puerto Rico subsidiary, showing a large profit in Puerto Rico.

They don’t pay much tax on that profit, but they also didn’t pay workers, rent, utilities, or anything else that would bring economic activity to Puerto Rico.

We’re using a hypothetical example, but Microsoft did almost exactly what we’ve described.

Special tax incentive laws in Puerto Rico allow a company owner to have just one employee — it can be the owner of the company — living in Puerto Rico. This is enough of an investment to shield the company from paying corporate taxes. These deals are used to shelter from taxes, and they don’t bring jobs to Puerto Rico.

Would businesses locate in Puerto Rico if they had to pay taxes?

The idea that Puerto Rico has nothing to offer investors besides shady tax deals is offensive to the Island. Puerto Rico has many of the advantages municipalities in the states offer when they work to draw investments into their communities:

- An educated workforce, with institutions of higher learning that offer ongoing training opportunities

- A bilingual workforce, which is increasingly desirable for American companies

- Affordable living with a wide range of amenities

- A culture supportive of business and entrepreneurship

- Eligibility for loans and grants as well as tax incentives

Puerto Rico also has amazing natural beauty and year-round sunshine, which those stateside locations can’t generally claim.

Note that these factors are appealing not only for companies that are not currently on the Island, but also for Island entrepreneurs. Unlike the special tax deals for the wealthy, these advantages encourage local residents to create businesses, too.

Would being a state change these things?

One of the oddest claims in the essay we mentioned is that statehood would take away the advantages Puerto Rico currently has.

Puerto Rico has a higher poverty rate than any state. Most of the population would not pay income taxes because they don’t earn enough money to owe taxes. Instead, they would receive tax credits for which Puerto Rico is currently not eligible. For individuals, filing for federal income tax would be a plus.

Local businesses don’t get to participate in the special tax deals, either, so corporate income tax would not be a hardship for the majority of business owners. For those wealthy companies and individuals who wash their profits through Puerto Rico to avoid taxes, statehood would mean the jig is up.

The rest of the advantages won’t be diminished by statehood.

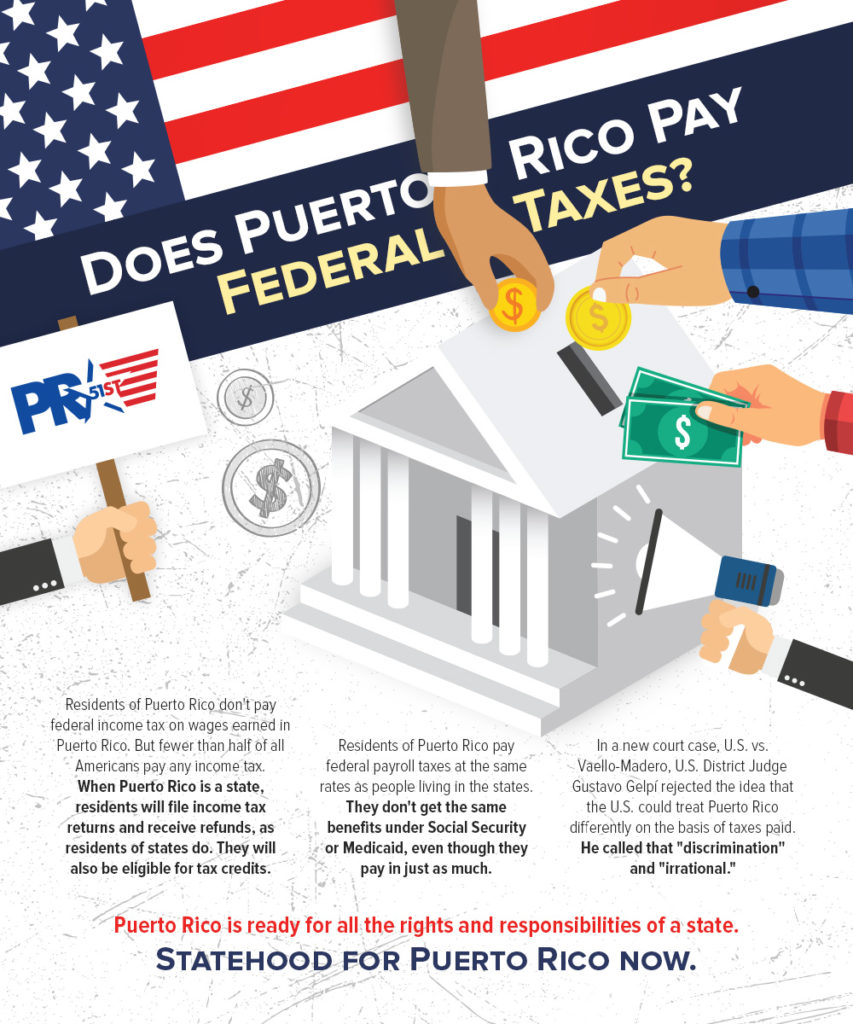

And Puerto Rico actually does pay federal taxes already. Apart from income tax, Puerto Rico pays the same federal taxes as states — without getting the same benefits. As a state, Puerto Rico will get the full benefits.

Another odd claim

That essay specifically says that Puerto Rico has a very high poverty rate and that “the nation” needs all the resources it can get. Puerto Rico is a territory, not a nation, and being a territory is a primary reason for its lack of resources.

If Puerto Rico as a territory had great business advantages, it wouldn’t also have such a high poverty rate. As a state, Puerto Rico can expect to grow more prosperous, like every territory which has already become a state.

Fear of taxes is one reason some people hesitate to support statehood, but the facts do not support this position.

One response

Kudos! Excellent, straight forward summary.

In addition, under Statehood, local PR residents will have greater investments tools, unavailable now -under territorial status IRS restrictions.

For example, PR Residents will have broader IRA’s and Keogh plans options; currently (under local banks- PR -IRS control), very restricted, costly and yielding poor returns.

Having access to broader investments options, will encourage local individual savings and investments, beyond real estate and the Bond markets.

PR Statehood, is the only way forward to honor our USA Constitution, stabilize Puerto Rico’s social, political and economic status, and permanently ensure our Nation’s -regional and international- National Security.