Do Puerto Ricans pay taxes? Things have changed in the past couple of years, so here is an update on this question.

Income tax

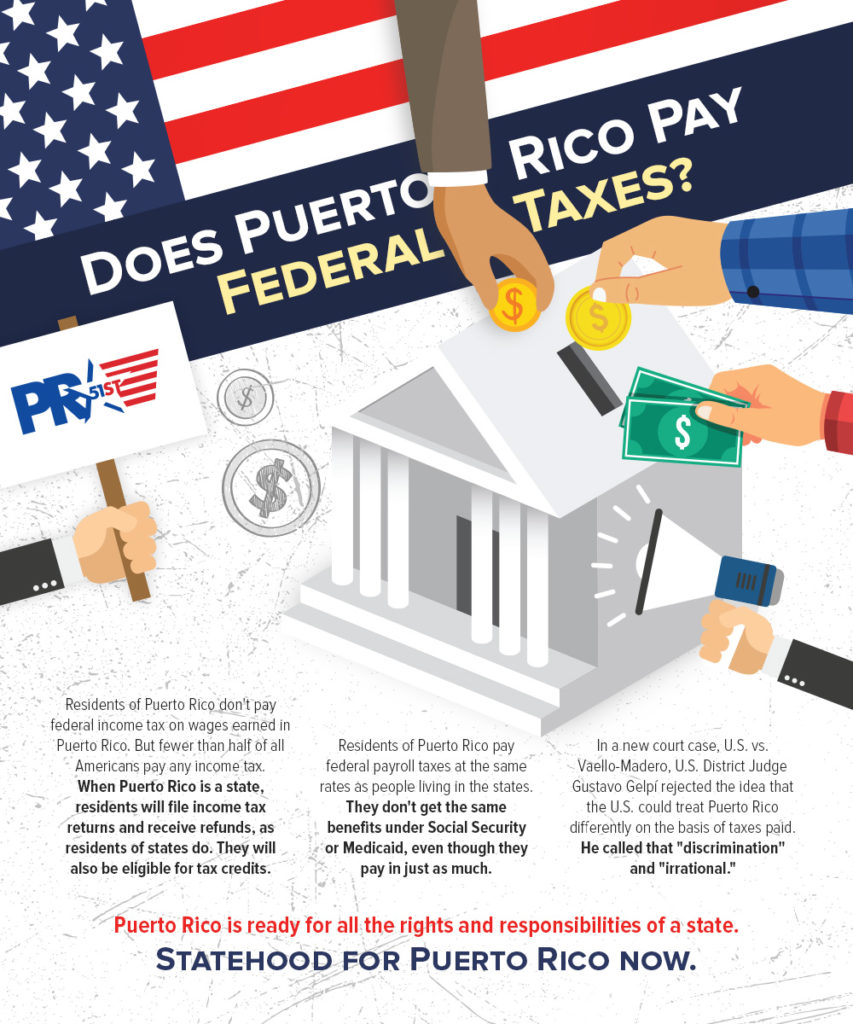

Residents of Puerto Rico usually don’t have to pay federal income tax on the wages they earn in Puerto Rico. The reason is that Puerto Rico needs revenue from its citizens and the federal government thought that people in Puerto Rico would have trouble paying both federal and local taxes. The average income in Puerto Rico is significantly lower than the income in any of the 50 states, so this seems reasonable on the face of it.

However, things are not always as they seem. For one thing, this fact is often used to justify the inequity in federal support. For example, when the Supreme Court agreed that Congress could discriminate against Puerto Rico by refusing to pay Supplemental Security Benefits one of their main reasons was that Puerto Ricans don’t pay income tax — but SSI recipients do not earn enough to pay income tax. In fact, most residents of Puerto Rico, just like about half of the residents of the states, do not earn enough to pay income tax.

Until recently, Puerto Ricans were not eligible for tax credits which many people living in the states receive. Now, Puerto Ricans can receive Child Tax Credits, but that can change at any time. Congress makes this decision and can change their minds, and the law, at any time. As a state, Puerto Rico would not be subject to this uncertainty.

Note that Puerto Rico continues to have special income tax deals for corporations and wealthy residents. These special deals are not available for most Puerto Ricans.

Payroll taxes

Workers in Puerto Rico pay payroll taxes even when they don’t pay federal income tax. Most Americans living in the states pay more in payroll taxes than they do in income taxes, and that is true for people living in Puerto Rico as well. Puerto Ricans pay at the same rate as people living in the states.

However, they do not receive the same benefits from Social Security, Medicaid, and Medicare as people living in the states.

Sales tax

Puerto Rico has the highest sales tax rates in the United States. While the rate varies by taxability of specific goods and services, as is true for states as well, the basic sales tax rate is 11.5%. This is higher than any state. States range from no sales tax in five states to 7.25% in California.

While many people believe that the Jones Act causes higher prices on the Island, the sales tax rate is much more significant.

Add everything up, and you will see that Puerto Ricans pay plenty in taxes and receive less in benefits. Puerto Rico is ready for the rights and responsibilities of statehood.

No responses yet